Wednesday, September 13, 2017

When a rising stock market is a bad thing

If the world had a single cauldron for mixing various monetary phenomena, it would be Zimbabwe. Over the last two decades, it has experienced pretty much everything that can happen to money, from hyperinflation to deflation, demonetization to remonetization, dollarization and de-dollarization, bank runs, bank walks, and more.

Adding to this mix, the Zimbabwe Industrial Index—an indicator of local stock prices—has recently gone parabolic, having more than tripled over the last twelve months. That's a good sign, right? Beware, these gains aren't real. As is often the case in Zimbabwe, the rise in stock prices is a purely monetary phenomenon.

Ever since the great Zimbabwean hyperinflation led to the domestic currency becoming worthless in 2008, U.S. dollars have served as the nation's currency and unit of account. However, Zimbabwe's central bank, the Reserve Bank of Zimbabwe (RBZ), has spent much of the last two or so years surreptitiously bringing a new parallel monetary unit into circulation. These new units, informally referred to as RTGS dollars, are a digital form of money, specifically a deposit held at the central bank. (I described them here).

At the outset, RTGS dollars were denominated in U.S. dollars and supposedly convertible into genuine U.S. banknotes. We now know these units were only masquerading as U.S. dollars. By early 2016, huge lineups began to appear outside banks as Zimbabweans unsuccessfully tried to convert their deposits into real U.S. cash. When conversions finally became possible it was only because the RBZ had introduced its own paper currency, a 'bond note', in late 2016. These bond notes were themselves supposed to be fully fungible with U.S. dollars thanks to a promise of 1:1 convertibility, at least if you believed the nation's central banker, but this has never been the case.

Over the last year a great redenomination has been occurring as all Zimbabwean prices—including that of ZSE-listed stocks—are shifted over from a genuine U.S. dollar standard to an RTGS dollars/bond note standard. Prior to 2016, if you sold a stock or received a dividend, you'd get U.S. dollars, or at least a pretty decent claim on the real thing. Now, you get RTGS dollars—which can only be cashed out into an equally dodgy parallel currency, bond notes.

The incredible 300% rise in the Zimbabwe Industrial Index is a reflection of the redenomination of stocks into an inferior monetary unit and that unit's continued deterioration. For instance, if you were willing to sell your shares of Delta Brewing for $10 prior to the redenomination, you'd only be willing to sell them at a much higher level post-redenomination, say $15, in order to adjust for the diminished purchasing power of the money you'll receive upon sale. RTGS dollars are not U.S. dollars. After adjusting the Zimbabwe Industrial Index for the decline in the value of the money in which stocks are denominated, things certainly wouldn't look as bullish as the chart above indicates.

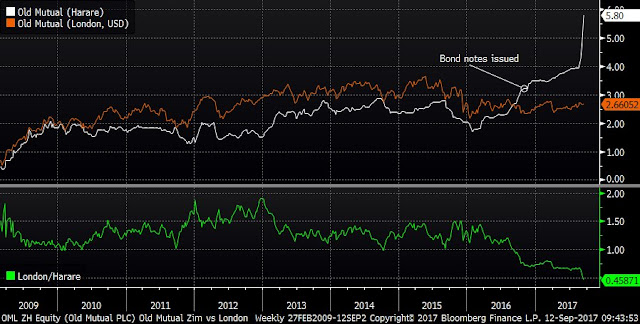

What is the actual exchange rate between RTGS dollars/bond notes? We can get a pretty good idea by looking at the prices of dual-listed shares. The shares of Old Mutual, a global financial company, trade in both Harare and on the London Stock Exchange. See chart below, courtesy of Gareth on Twitter.

Old Mutual investors have the ability to deregister their shares from one exchange and transfer them for re-registration on the other. Arbitrage should keep the prices of each listing in line. After all, if the price in London is too high, investors need only buy the shares in Zimbabwe, transfer them to London, sell, and repurchase in Zimbabwe, earning risk-free profits. If the price in Zimbabwe is too high, just do the reverse.

The ratio of the two Old Mutual listings (the green line above) provides us with the implicit exchange rate between genuine U.S. dollars and dollars held in Zimbabwe. In 2009 the two listings traded close to parity (i.e. around $2 each), which makes sense because Zimbabwe had dollarized by then, and dollars-in-Zimbabwe were fungible with regular dollars. From 2010 to 2016 the dollar-denominated price in London was above the price in Zimbabwe. This discrepancy may be due in part to the fact that Harare-listed Old Mutual shares aren't very liquid, so they suffer a liquidity discount. Another reason is that the authorities place a ceiling (i.e. fungibility limits) on the number of Old Mutual shares that can be deregistered from the Harare market and dropshipped into London. With all of the space under the ceiling having presumably been used up, it would have been impossible to arbitrage the difference between the two prices, the Harare counter falling to a permanent discount.

So the Old Mutual ratio was probably not a good indicator of the implicit exchange rate between 2010 and 2016. However, in June 2016 this ceiling was raised, at which point arbitrage would have once again been possible. As such, the ratio would have probably returned to providing a decent indicator of the exchange rate between a dollar-in-Zimbabwe and a genuine dollar.

You can see that Old Mutual is currently valued at $5.80 in Zimbabwe whereas it only trades in London for around $2.66 per share (after converting from pounds into US dollars). This means that Zimbabweans are willing to put $5.80 in one end of the sausage maker in order to get $2.66 out from the other. So a dollar-in-Zimbabwe, which was trading at par to U.S. dollars just two years ago, is now worth just 46 cents. That's quite the inflation rate. I don't see things slowing down, either.

P.S.: Some investors will no doubt want to say the same thing is going on with the US and Europe with loose monetary policy creating so-called asset price inflation. I disagree.

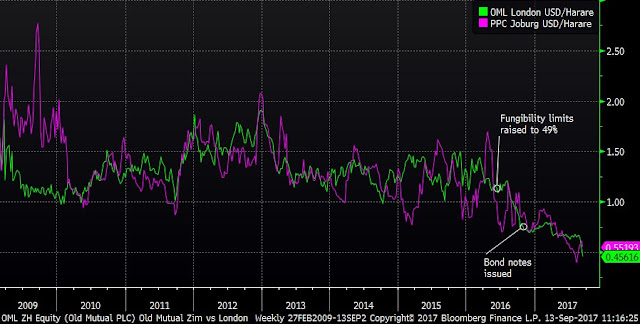

P.P.S: Gareth has provided another chart. It shows the implied exchange rate between dollars-in-Zimbabwe and genuine U.S. dollars using the only other fully transferable dual-listed counter, PPC, a cement company that is also listed in Johannesburg. Note how close the PPC rate follows the Old Mutual rate.

Subscribe to:

Post Comments (Atom)

....Some investors will no doubt want to say the same thing is going on with the US and Europe with loose monetary policy creating so-called asset price inflation. I disagree....

ReplyDeletewould be interesting why you believe this is not the case (of course, apart form differences in degree). Are you of the opinion, like Eugene Fama, that CB actions have no effect on asset prices?

Would be an interesting post....

Didn't we have a debate along these lines ages ago? Let me see... ah, here:

Deletehttp://jpkoning.blogspot.ca/2016/07/monetary-policy-as-system-of-connected.html

The short answer is that if a central bank sets off a hot potato effect through easy monetary policy, it should pervade all sectors of the economy, first pushing asset markets higher and then consumer markets.

Zimbabwe is conforming to this pattern. Its stock market is rising, but it is also now experiencing consumer price inflation after a long period of 1-2% deflation. Anecdotal evidence shows a large pick up in the price of basic consumer goods this year.

In the US, however, the strong performance of the stock market was never accompanied by strong inflation. So I don't think the stock market's rise in the US (or Europe) had much to do with Fed monetary policy.

I noticed JP Koning's reply and took time to re-read the reference. JP treats money as if it was deferred consumption, not as if it was an asset. He continues the deferred consumption logic to arrive at an expectation of higher future consumer prices when deferring relaxes.

DeleteWe can depart from the JP logic and assume that money is an asset. As an asset, money only entitles the owner to future consumption without any commitment to actual consumption. This opens the door to governmental management of actual consumption by encouraging or discouraging spending (done through borrowing and interest rates).

We can see that this kind of governmental management is occurring when government borrows money from the public (and pays interest) when government could obtain ALL it's spending money by simple (and cheap) printing.

In the Zimbabwe case, they seem to have dropped interest rates in 2017 (down to about 9% from "averaged 12.74 percent from 2011 until 2017". [Note 1.] ). Couple this observation with JP's index chart and I conclude that government has decided to reduce support for the Zimbabwe currency. The result is a shift of investor willingness to price-up the stock asset coupled with less enthusiasm for Zimbabwe cash or bonds.

When we consider money as an asset, there is no compelling reason to think that people should spend newly created money quickly. This is especially true if government is borrowing from the public as a continuation of a long standing pattern.

In the US, the long-standing pattern seems to be that most people spend nearly all their income on essential consumption and taxes. Only a few have the ability to both save (to fund governmental borrowing needs) and increase spending. The few are not enough to overcome the effects of leveling measures such as increased automation, imported consumer goods, and taxation which increases with consumption.

On the other hand, in Zimbabwe, governmental borrowing has skyrocketed over the last two years, reaching 84% of GDP in 2016 (Note 2.). This demonstrates money creation at a rate far exceeding the money creation rate in the US. This difference in the rate of creating money can partly explain the difference in inflation between the two currencies.

The reader can see that I think money should be treated as an asset.

Note 1. This quote is taken from https://tradingeconomics.com/zimbabwe/interest-rate

Note 2. This figure taken from https://tradingeconomics.com/zimbabwe/government-debt-to-gdp

@JP Koning

DeleteTrue...I had entirely forgotten :-)

I remember it was somewhat technical, will reread our discussion,as my memory serves me badly in this case.

However, just taking your short summary as a starting point, if you permit, two follow up questions emerge:

1. Couldn't the difference in behavior between Simbabwe (asset+basic goods inflation) and the developed world (only asset, no basic goods inflation) just be one of degree? I mean, nobody is suggesting that money printing is at Simbabwean levels, i.e. exponential growth in money supply.

2. also the "inflation channel" is probably different in Simbabwe and hence you would not expect to see exactly the same sequence. I suppose that the CB of Simbabwe prints money to pay off the government cronies (nobody can rule without the support of the guys with the gunds), it is more akin to helicopter money. Asset price inflation is a second and third round effect.

A modern central bank does nothing of that kind (alhtough it has been suggested, i.e. helicopter money). It either buys assets directly, or creates credit money against assets (repo), same for the private banking system, where regulation heavily favours asset backed lending (starting with Basel I).

I believe these differenes have a major effect on observed prices....

@ Roger,

DeleteI think this is similar/related to what I say in the response to JP Koening..

"I mean, nobody is suggesting that money printing is at Simbabwean levels, i.e. exponential growth in money supply."

DeleteNo? What about the huge ramp up in central bank balance sheets, ie the Fed, ECB, and Japan?

https://www.japanmacroadvisors.com/page/category/bank-of-japan/boj-balance-sheet/

I think you nail the difference here:

"...CB of Simbabwe prints money to pay off the government cronies.... A modern central bank does nothing of that kind ... It either buys assets directly, or creates credit money against assets (repo)..."

Western central banks are not being used to prop up fiscally unsound governments.

No? What about the huge ramp up in central bank balance sheets, ie the Fed, ECB, and Japan?

DeleteWell, I am talking about the total money supply, and whereas it is true that CB's have exponentially growing M1 supply, this is not true for bank balance sheets, and hence not true for M2, M3... Deutsche is half of what it was pre-crisis, same for most US, or European banks - hence no TOTAL exponential growth.

That's why you do not see the same inflation dynamics, I would say

Hah. We've had that debate before, too.

Deletehttps://jpkoning.blogspot.ca/2017/01/if-fed-was-so-aggressive-why-didnt-we.html?showComment=1484578458263#c2435438505785087214

Right, but I am not sure what the conclusion was, even after rereading it. These things are difficult to discuss on a forum.

DeleteIf you permit again, I will sum up our discussion back then and our discussion so far. We agree that beta banks matter. We agree that there is interplay between CB (alpha) and commercial (beta) banks. We basically agreed that going full Zimbabwe is difficult (or not happening) given current cultural/political factors. (In Zimbabwe there are no beta banks really, only the CB matters, whereas here there is this complicated interplay and the beta banks have to play along which they have not done so far).

Which is why we are NOT in a "full Zimbabwe" type of situation, despite exponential growth of CB balance sheets.

Now, I say that since we are NOT Zimbabwe, we should NOT expect to see the same inflation dynamics (asset inflation + (rampant) goods inflation). As simple as that.

But from this, one cannot conclude (as you seem to do, maybe I am wrong) that just because we do not observe Zimbabwe inflation dynamics, it follows that an exponentially rising alpha, i.e. CB balance sheet does not/cannot cause asset price inflation.

The reason: your "hot potato" effect that links asset and goods inflation might either be delayed due to a difference in degree (we are not Zimbabwe), or due to impaired links between asset and good markets (For example: it could be that those benefiting from asset inflation have a higher propensity to save than to consume and are just recycling their gains, for example).

Could be, right?

Zimbabwe is one extreme, a stable monetary system with no inflation dynamics another. There is a lot of gray in between, which is exactly where we find ourselves. However, just because we are not at one extreme, doesn't mean monetary intervention has no effect on asset prices whatsoever.

I hope this was an accurate summary of our views (and past discussions). I seriously hope I have not missed another one :-).

I once wrote a more technical blog post on this topic, which you may find interesting.

https://viennacapitalist.com/2014/06/25/on-eugene-fama-and-fed-qe/

Really respect your knowledge of monetary theory and history, which is why it is important for me to understand our differences on this matter.

Good response.

Delete"Really respect your knowledge of monetary theory and history, which is why it is important for me to understand our differences on this matter."

Thanks!

Going through your post, I agree with Mises and Fama. Central bank money is different from bonds because the former provides monetary services (i.e. the Mises view)

However, there may be situations in which--on the margin--those monetary services are no longer valuable. At which point Fama is right, money loses its uniqueness and QE is just a swap of bonds for bonds. The recent massive increase in the Fed's balance sheet is one example in which monetary services are no longer valued. This has only occured at the margin (i.e. at the intersection of the supply and demand curve). Infra-marginal owners (those who own money before the marginal buyer/seller) will still value monetary services.

Once we reach the point at which monetary services have a marginal value of 0, then QE cannot set off a hot potato effect. It is neutral.

A stock market index is a measure of change in the mean of a fairly static distribution. Aggregate Sstock indices almost always track regulatory, central bank, exchange rate or fiscal events. Events that have their effect via debt channels.

ReplyDeleteIn our case, we have a well managed debt channel yielding low volatility, and under this scenario, the PE ratio should rise to match the one year, if option pricing works. If we can control debt volatility in the Treasury market, say if we had some special meetings between Treasury, the major bank CEOs and the debt advisory committee such that wealthy people could produce funds exactly on time as treasury issues debt, then volatility can be controlled; we could actually control the pace of the Black-Scholes forward options, guarantee a return for wealthy people willing to participate in government debt management.

I certainly appreciate your research supporting your opening observation "If the world had a single cauldron for mixing various monetary phenomena, it would be Zimbabwe".

ReplyDeleteZimbabwe seems to be conducting monetary experiment after monetary experiment. If there is such a thing as monetary principles, we should be able to learn principles from these experiments.

After reading this post, I come away thinking that something is causing the Zimbabwe money supply to be unstable on the rapidly increasing side. Maybe this just reflects my personal bias as you did not attribute the rapid decline in currency value to any particular cause.

Then you close with a boldly printed "PS" which seems to de-link money supply and asset prices. Hmmm. This leaves me with a question as to what you attribute the source of Zimbabwe monetary instability.

Of course, monetary principles should apply to the currency from every country. When results vary, the variation should trace to currency management.

"Maybe this just reflects my personal bias as you did not attribute the rapid decline in currency value to any particular cause."

DeleteTo understand you'd have to get into Zimbabwean politics. I'd really suggest reading anything by Eddie Cross, such as this:

http://www.politicsweb.co.za/opinion/zimbabwe-robbery-by-reserve-bank

http://www.eddiecross.africanherd.com/

The short answer is that the Mugabe government is creating massive amounts of RTGS dollars/bond notes to fund spending.

Very interesting! Thanks again, JP.

ReplyDeleteYou said that there's a great redenomination occuring. Does this mean that things didn't play out as you predicted last summer (from the post on bond notes you linked to in your text):

"This means that if the bond note turns out to be a sham and begins to inflate, Zimbabwean prices--expressed in U.S. dollars--will stay constant."

Or does the truth lie in the middle? (There's a possible connection here to our discussion about dollars and LETS dollars here.)

Yes, in my first post on bond notes I overestimated the stickiness of the unit of account and underestimated the ability of the governing regime to enforce a switch.

DeleteBut we'll have to see how it plays out, especially with consumer prices.

Yes, we'll see.

DeleteWhat I don't fully understand is why would it matter whether prices are primarily expressed in US$ or RTGS$? It's a dual-price system, so prices will be expressed in both. There were mark and dollar prices for goods in Weimar, too.

Inflation in RTGS$ will not go away if we decide to focus on prices expressed in US$. It will not go away even if people agree that the US$ price is somehow more official than the RTGS$ price. And if most of the transactions take place using bond notes / Reserve Bank ledger, it will give little comfort to people to know that prices in US$ haven't changed.

Of course, if a significant amount of trade within Zimbabwe takes place using Fed notes, then it probably makes life easier, at least for those able to get their hands on Fed notes. That could offer some relief, I suppose. But could it be that people start hoarding Fed notes, as they might expect deflation in US$ terms? As far as I know, during all hyperinflationary periods since 1900 there has been deflation in US$ terms -- Weimar included. The value of a hard currency goes up when the value of a soft currency goes down, and not only in relative terms. Thinking out loud here.

I said: "The value of a hard currency goes up when the value of a soft currency goes down, and not only in relative terms."

DeleteOne could think of this by looking at the "transactions services" each currency offers. The higher the inflation rate measured in RTGS$, the less convenient it becomes for people to use bond notes. If the inflation rate in RTGS$ terms was low, then bond notes would offer a good substitute for Fed notes. But if inflation rate is high, then the real cost of using bond notes goes up and people are willing to pay more -- in real terms -- for the "transactions services" offered by Fed notes (that is, there will be deflation in US$ terms).

How does this sound?

OK, I found this from you in your post about RTGS dollars (first link in your blog text):

Delete--------------------------------------------------------

If the RBZ-issued electronic dollar continues to inflate then electronic dollar sticker price will rise but the U.S. paper dollar price will stay constant. This second set of prices would at least provide some modicum of price stability to the nation.

Not so fast. Mangudya warns that the central bank will prosecute any retailer that sets two prices. If retailers comply and set only one price for their wares, that effectively undervalues U.S. banknotes and overvalues RBZ-issued U.S. electronic dollars. Gresham's law will take hold as shoppers use only bad electronic dollars to pay for things while hoarding their good, and undervalued, paper dollars in their wallets. Unwilling to be the dupes and accumulate overvalued and unwanted electronic dollars, retailers will have no choice but to jack up their prices, essentially adopting the RBZ U.S. e-dollar as the standard unit of account, or unit in which they set prices. With U.S. dollars no longer being used as a medium of exchange and unit of account, price stability in Zimbabwe will cease to exist."

----------------------------------------------------------

So it seems you and I are pretty much on the same page here.

"It's a dual-price system, so prices will be expressed in both. There were mark and dollar prices for goods in Weimar, too."

DeleteNo, it's not a dual price system. (Well, in some retail settings it still is.) But in the specific context of this post, the Zimbabwe Stock Exchange expresses prices in only one unit of account, and that unit is no longer dollars, it's RTGS dollars.

If $ prices on the ZSE were defined by real dollars, then the collapse in the purchasing power of RTGS dollars would not have caused a massive rally in the Industrials Index.

"What I don't fully understand is why would it matter whether prices are primarily expressed in US$ or RTGS$"

Costs arising from money illusion are probably much more likely in a scenario where the unstable RTGS$ becomes definition for the unit of account. If people aren't fooled by money illusion, then it doesn't really matter.

Sorry, JP. I rarely manage to stay within the specific context of posts.

DeleteYes, only one UoA is used to express official stock prices at the ZSE.

When it comes to costs, what is probably of most importance is in which UoA people's salaries are denominated, regardless of in which UoA (other) prices are expressed.

So how does one go about de listing old mutual shares on the jse and moving them to Zimbabwe

ReplyDeleteYou'd need to ask your broker. I don't know the procedure.

Delete@JP Koning Does it mean that buying Shares on the Zimbabwe Stock Exchange for now is NOT WORTH IT since share prices are fictitiously valued?.

ReplyDeleteNo, it means that the value of Old Mutual shares represents the true exchange rate between Zimbabwe's new US dollars and genuine dollars.

Delete